- Corporate Profile

- Vision & Mission

- Trust Structure

- The Sponsor

- History & Milestones

- Corporate Directory

Corporate Profile

Mapletree Logistics Trust (“MLT”) is Singapore’s first Asia Pacific- focused logistics real estate investment trust. Listed on the Singapore Exchange Securities Trading Limited in 2005, MLT invests in a diversified portfolio of quality, well-located, income producing logistics real estate in Singapore, Australia, China, Hong Kong SAR, India, Japan, Malaysia, South Korea and Vietnam.

MLT is managed by Mapletree Logistics Trust Management Ltd. (the “Manager”), who is committed to providing Unitholders with competitive total returns through the following strategies:

- optimising organic growth and property yield from the existing portfolio;

- making yield accretive acquisitions of good quality logistics properties; and

- managing capital to maintain MLT’s strong balance sheet and provide financial flexibility for growth.

Vision

To be the preferred real estate partner of choice to customers requiring high quality logistics and distribution spaces in Asia Pacific.

Mission

To provide Unitholders with competitive total returns through regular distributions and growth in asset value.

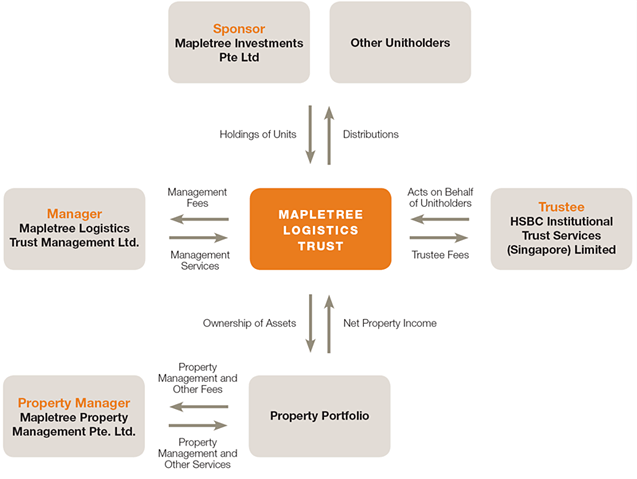

Trust Structure

As a REIT established in Singapore, MLT is constituted by the Trust Deed. A copy of the Trust Deed can be inspected at the registered office of the Manager, which is located at 10 Pasir Panjang Road, #13-01 Mapletree Business City, Singapore 117438, subject to prior appointment.

The Sponsor

Headquartered in Singapore, Mapletree is a global real estate development, investment, capital and property management company committed to sustainability. Its strategic focus is to invest in markets and real estate sectors with good growth potential. By combining its key strengths, the Group has established a track record of award-winning projects, and delivers consistently attractive returns across real estate asset classes.

The Group manages three Singapore-listed real estate investment trusts (“REITs”) and nine private equity real estate funds, which hold a diverse portfolio of assets in Asia Pacific, Europe, the United Kingdom (“UK”) and the United States (“US”). As at 31 March 2025, Mapletree owns and manages S$80.3 billion of logistics, office, data centre, student housing and other properties.

The Group’s assets are located across 13 markets globally, namely Singapore, Australia, Canada, China, Europe, Hong Kong SAR, India, Japan, Malaysia, South Korea, the UK, the US and Vietnam. To support its global operations, Mapletree has established an extensive network of offices in these markets.

For more information, please visit www.mapletree.com.sg.

History & Milestones

Corporate Directory

Manager

Mapletree Logistics Trust Management Ltd.

Company registration number: 200500947N

Manager’s Registered Office

10 Pasir Panjang Road

#13-01 Mapletree Business City

Singapore 117438

Tel: +65 6377 6111

Fax: +65 6273 2281

Website: www.mapletreelogisticstrust.com

Email: Ask-MapletreeLog@mapletree.com.sg

Trustee

HSBC Institutional Trust Services (Singapore) Limited

Registered Address

10 Marina Boulevard

Marina Bay Financial Centre

Tower 2 #48-01

Singapore 018983

Correspondence Address

10 Marina Boulevard

Marina Bay Financial Centre

Tower 2 #45-01

Singapore 018983

Tel: +65 6658 6667

Fax: +65 6534 5526

Unit Registrar

Boardroom Corporate & Advisory Services Pte. Ltd.

1 Harbourfront Avenue

Keppel Bay Tower #14-07

Singapore 098632

Tel: +65 6536 5355

Fax: +65 6438 8710

Email: srs.teamd@boardroomlimited.com

Auditor

PricewaterhouseCoopers LLP

7 Straits View,

Marina One East Tower, Level 12

Singapore 018936

Tel: +65 6236 3388

Fax: +65 6236 3300

Partner-in-charge

Mr Alex Toh Wee Keong

(Appointed from the financial year ended 31 March 2023)